Article

Democrats Seek Shareholder Voting on Executive PayNY Times, By STEPHEN LABATON

Washington,

April 19, 2007

|

Agustina Guerrero

((813)871-2817)

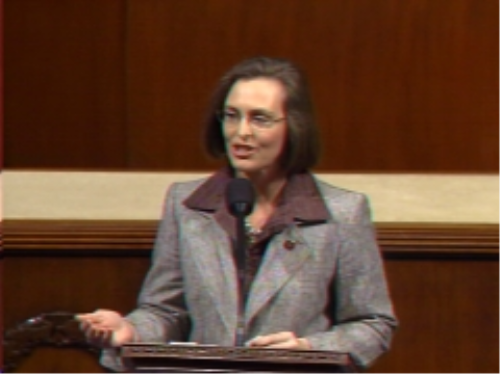

NY TIMES - Representative Kathy Castor, Democrat of Florida, said the legislation would “provide a reality check to skyrocketing pay packages of senior executives.”

“The average C.E.O. makes more money before lunch than the average worker earns all year,” she said, urging House members to “allow shareholders to send a message about pay packages that boggle the mind.”

Shareholders would have the right to a nonbinding vote on the pay packages of senior executives of public companies under a bill that the House began debating Wednesday.

The measure would also give shareholders the right to vote on any “golden parachute” compensation plans that are awarded to executives while they are negotiating the purchase or sale of a company. The measure is sponsored by Representative Barney Frank, Democrat of Massachusetts, and has been largely supported by Democrats and opposed by Republicans. It is expected to be approved by the House by the end of the week. But it faces significant political obstacles. There is no comparable measure in the Senate. And this week, the White House issued a statement opposing the legislation, saying it “does not believe that Congress should mandate the process by which executive compensation is approved.” The statement noted that the Securities and Exchange Commission last year approved a regulation requiring companies to provide more detailed information to shareholders about the pay of top executives and that other changes in rules had strengthened the governance of corporations. “Before additional corporate governance requirements are legislated,” it said, “the administration believes that recent enhancements should be given time to take effect.” Mr. Frank, who has introduced similar bills in the past, has said he decided to make the votes nonbinding because such resolutions would be enough to put significant pressure on boards in cases where there was a clear consensus that the pay of top executives was out of line with a company’s performance. Institutional investors have strongly supported the measure, although some have sought even greater authority that would allow them to propose their own directors, as well as votes on compensation. Influential business groups, including the United States Chamber of Commerce and the Business Roundtable, an organization of chief executives from many of the largest corporations, oppose the measure. Since 2002, shareholders of British companies have had the authority to conduct nonbinding votes on executive compensation. They have rarely invoked the provision, compensation experts said, adding that the only instance when investors voted against the pay package of executives occurred in 2003 at GlaxoSmithKline. Despite the bill’s difficult prospects, its Democratic supporters seemed to relish the debate on Wednesday, which put Republican opponents in the awkward position of seeming to defend excessive pay packages. During a spirited debate this afternoon, Republicans raised a variety of complaints about the measure. They said it was toothless because it was nonbinding. But at the same time, they said it would unnecessarily intrude into the affairs of corporate boards, and that it might prompt companies to move their operations overseas or go private to avoid its effects. They also said it would provide a new weapon to groups including environmentalists and labor unions that would use these votes to promote narrow agendas. And they said it would promote frivolous litigation by shareholders. “When Congress becomes a second guesser and a judge for executive pay for every corporation in America, ladies and gentlemen, we are going down a slippery slope,” said Representative Spencer Bachus of Alabama, the ranking Republican on the House Financial Services Committee. “How many times has this Congress substituted its judgment for the American people? For people in business? That is again what this legislation is doing. Congress should never rush in and begin to change the free-enterprise system, our system of competition between companies.” But Mr. Frank, the committee chairman, dismissed the criticism. “I often disagree with my colleagues on the other side, but I have rarely been as baffled by the illogic of their arguments as I am today,” Mr. Frank said. “This is a bill that has been condemned for being bullying and intrusive, and for being toothless. The toothless bully is a new concept. “My friend from Alabama says he is not interested in defending egregious executive salaries. But in fact, he is.” He called the measure “a moderate and temperate approach to the issue of runaway and excessive compensation.” Representative Kathy Castor, Democrat of Florida, said the legislation would “provide a reality check to skyrocketing pay packages of senior executives.” “The average C.E.O. makes more money before lunch than the average worker earns all year,” she said, urging House members to “allow shareholders to send a message about pay packages that boggle the mind.” But Representative Pete Sessions, Republican of Texas, said the legislation would do more harm than good. “This provides outsiders such as big labor bosses, environmentalists and so-called consumer activists the ability to compel boards to do their bidding,” he said. “This information is already fully disclosed to investors.” Republicans planned to offer amendments to derail or water down the bill. One would issue a Congressional declaration that the S.E.C. rules on disclosure are adequate, and a second would require the government to study whether shareholder votes on pay packages make it more difficult for companies to recruit or retain executives. A third would have the effect of exempting virtually every company from the bill’s provisions, while a fourth would require investor groups involved in the voting to disclose who they are and how much they spent on any campaign for or against the ballot proposals. |